Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site.

First, we provide paid placements to advertisers to present their offers.

This compensation comes from two main sources.

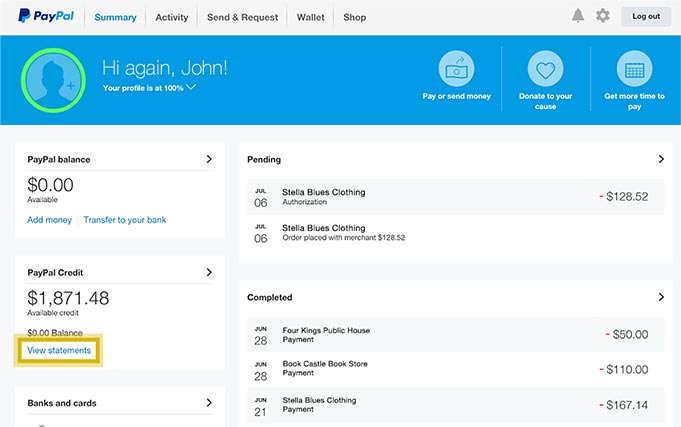

Paypal friends and family limit for free#

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective. In addition, Chase has been reported to be sending notices to existing cardmembers updating their terms and conditions to include person-to-person money transfers in the list of transaction types where they charge a cash advance fee. Since this change has been implemented, some credit card users have reported being charged a cash advance fee when sending money using PayPal. This change means that banks can now charge cash advance fees for things like person-to-person money transfers through services like PayPal and Venmo. In 2020, the New York Times reported on a change in the way that money transfer transactions are coded and processed through Visa and Mastercard. If you have recently applied for a credit card that offers a welcome bonus after a certain amount of required spending, it might make sense to use PayPal to send money to another person using a credit card. In 2020, Chase included PayPal in its cash-back calendar during Q4 (October through December).Chase Freedom Flex℠ * has historically included PayPal in the bonus cash back offering. Categories earning bonus cash back change quarterly and have earning caps before their base rate earnings of 1% apply. Some credit cards, such as the Chase Freedom Flex℠ * offer rotating categories in which cardmembers enroll to earn 5% cash back. Credit Cards With Rotating 5% Bonus Categories Why Using a Credit Card Might Still Be Attractiveĭespite the fee PayPal charges, there are a few cases where you could come out ahead after the credit card fee. PayPal does not charge this fee for person-to-person money transfers using either your existing PayPal balance or a money transfer from your checking account.

This fee can quickly eclipse any credit card rewards you might earn.

Paypal friends and family limit plus#

PayPal charges 2.9%, plus a fixed fee of 30 cents to process a person-to-person money transfer using a credit card. One of the biggest drawbacks of using a credit card to send money to another person using PayPal is the processing fee. This article specifically covers using PayPal to send money to another person, not to pay for a purchase. Those types of transactions have a separate fee structure and are processed differently than person-to-person transactions. PayPal checkout is integrated onto many websites and many smaller merchants use PayPal to invoice and accept payment for goods and services. PayPal Is Much More Than Person-to-Person Payments There are some exceptions to this, but banks are also changing the way these transactions are processed, which might subject you to additional fees. Generally, the fees PayPal charges to send money to another person using a credit card are greater than the rewards you will earn, making it unattractive to use a credit card to send person-to-person money transfers through PayPal. After all, your credit card earns rewards-Why not earn additional cash back or transferable points when sending money? Naturally, you might wonder if you should use a credit card to send money to another person using PayPal. As of 2022, 209.3 million people worldwide use PayPal to send money to friends or acquaintances. PayPal is a convenient way to send money to a friend or family member and was probably the largest force in changing the way we send money to other people.

0 kommentar(er)

0 kommentar(er)